Investment

Comprehensive Investment Solutions

At GP Financial Services, we provide sophisticated investment strategies to help you grow and preserve your wealth in an ever-changing market landscape.

Stock Market

Directly invest in the equity market with our expert guidance. We provide real-time analysis, portfolio management, and trading strategies for both long-term wealth creation and short-term gains.

SIP (Systematic Investment Plan)

The smartest way to build wealth over time. Invest a fixed amount regularly in top-performing mutual funds and benefit from the power of compounding and rupee cost averaging.

Mutual Funds

A perfectly diversified portfolio managed by professionals. Choose from Equity, Debt, Hybrid, and Tax-saving (ELSS) funds tailored to your financial goals and risk profile.

Why Choose Our Investment Services?

We don't just manage assets; we build lasting partnerships based on trust, performance, and transparency.

Expert Portfolio Review

Regular analysis of your investments to ensure they're on track.

Diversified Asset Allocation

Spreading risk across various sectors and asset classes.

Research-Driven Insights

Making informed decisions based on deep market analysis.

Goal-Oriented Approach

Aligning your investments with your specific life milestones.

Start Your Investment

Get a free consultation from our experts and start building your wealth today.

*Investment in securities market are subject to market risks.

The Magic of SIP

Systematic Investment Plan (SIP) is not just an investment; it's a financial habit that builds your future, one small step at a time.

Disciplined Saving

Automates your savings journey by investing a fixed amount regularly, ensuring you save before you spend.

Rupee Cost Averaging

You buy more units when market is low and less when it's high, lowering the average cost of your investments.

Compound Interest

Reinvest your returns to earn more returns. Over long periods, this creates a massive snowball effect on your wealth.

Explore Types of SIPs

Choose the right SIP strategy that aligns perfectly with your financial flexibility and future goals.

Regular SIP

The most common form where you invest a fixed amount at regular intervals (monthly, quarterly).

Top-up SIP

Allows you to increase your SIP amount periodically as your income grows, accelerating wealth creation.

Flexible SIP

Gives you the flexibility to change the investment amount or skip a payment based on your cash flow.

Perpetual SIP

Unlike regular SIPs with a fixed tenure, this continues until you give instructions to stop it.

Multi SIP

A single instruction to invest in multiple schemes of the same fund house, simplifying your portfolio.

Trigger SIP

Investments are made based on specific market events, such as a particular level of the index or NAV.

Core Benefits of Modern Financial Planning

Tax Efficiency

Utilize ELSS and other instruments to minimize tax liability.

Liquidity

Easy access to your funds when you need them most.

Inflation Shield

Outperform inflation to maintain your purchasing power.

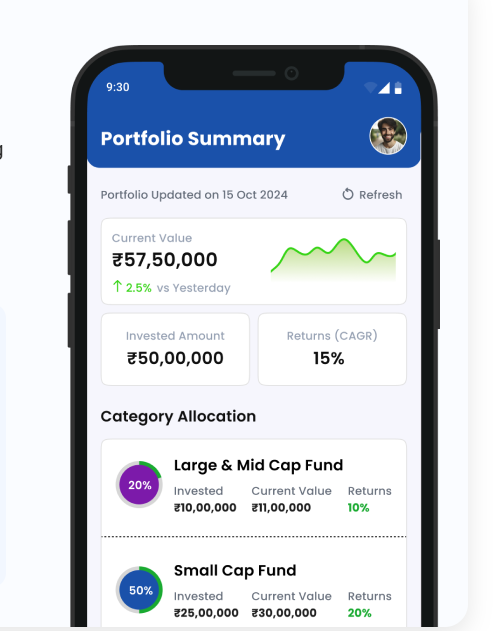

Transparency

Real-time tracking of your portfolio performance.